Borrowers

- 8% to 10%

Annual Return - Monthly Dividends

- Mortgage Secured

Investment

You deserve credit

for the equity you built

in your home.

Maybe the bank said “no” to your mortgage application or renewal – it happens. They may have explained it’s because you’re self-employed, new to Canada, have a shaky credit history or even an undischarged bankruptcy. That doesn’t mean you can’t get a first or second mortgage.

At EquityLine Mortgage Investment Corporation (MIC), we put more emphasis on your home than on you, and that lets us say “yes” more often to financing your needs. For nearly 50 years, MICs have been providing borrowers with shorter-term, well-regulated home equity lending solutions. Speak with us and we’ll work with you to change “no” into “yes.”

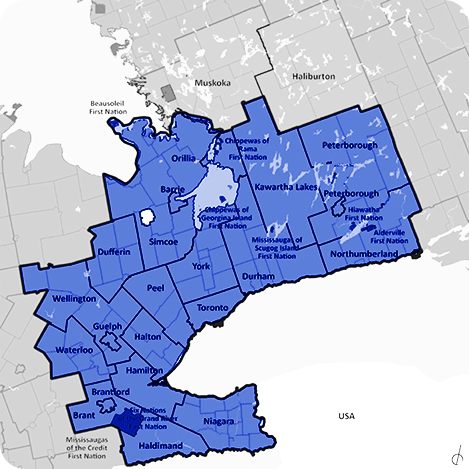

Where we lend

We fund first and second mortgages in the Greater Toronto Area (GTA) and Southern Ontario urban markets (with populations greater than 50,000) on single-family, multi-family homes and select commercial properties.

All properties are appraised by accredited appraisers.

What we offer

- Easy, quick application process

- Respectful, reasonable underwriting

- Approved funding in 2 to 5 business days

- Up to 80% loan-to-value (LTV) ratio

- Up to 12-month terms

- Monthly interest-only payments

We see you

-

Self-employed

Entrepreneurs deserve the flexibility to unlock their home equity, but often are turn downed by banks. One of the perks of being self-employed is getting to write off business expenses – but that reduces reported income and can stand in the way of mortgage approvals. EquityLine accepts self-declared income that reasonably estimates your annual income.

-

New to Canada

People who have just immigrated to Canada are often excited to get a fresh start. The trouble is that a fresh start in the banking world means no credit record and that can make it very hard to borrow. EquityLine approves mortgages based primarily on the value of the property and the equity you have in it, which allows us to give loans more often than banks.

-

Bridging to a new home

You’ve found the home of your dreams, but the closing date is sooner than you can arrange to sell your current place. That means you’ll be carrying two homes for a period of time. And then there are the moving costs. An EquityLine mortgage can be the bridge that gets you into your new home. You can repay it as soon as your old home closes.

-

Refinancing mortgage

Sometimes your mortgage renewal comes up at the worst possible moment. For people in temporary financial difficulties who can’t get a renewal approved at a traditional bank, EquityLine can provide bridge financing until your circumstances improve.

-

Renovating a home

Major home upgrades like redoing a kitchen or finishing a basement often require financing, and it makes a lot of sense to draw on the equity in your home to help pay for improvements to your home. EquityLine’s short-term loans are ideal to finance home renovations, especially when banks refuse.

-

Consolidating debt

Lots of debts in many places are hard to manage and, if they’re in high-interest credit facilities like credit cards, they can be very expensive too. An EquityLine mortgage lets you bring together all your liabilities in one place at one reasonable rate – saving you money

-

Transitioning to a new job

Career transitions can be tricky when you need financing. Maybe there’s a gap between the time you leave one job and start a new one and, just then, an unexpected expense comes up. Or perhaps you’ve just joined a new firm and the bank is asking for six months of pay stubs before advancing a loan. EquityLine can provide funding until you’re established in your new position.

-

Investing in professional development

Taking time away from work for a sabbatical or to pursue a one-year educational program is an investment in your professional development – but it may mean you need funding to cover some costs. EquityLine provides short-term loans secured by the equity you have in your home that can free you up for a “gap year” that advances your career.

4 steps to funding

- Complete our Quick Funding application below, telling us

the estimated value of your property, your total current

equity, and how much funding you need - Expect a response within 24 hours to discuss your situation

in more detail and explain next steps - Receive our underwriters’ decision within 5 business days

with our offer and detailed terms - Move forward with your goals supported by your

new funding

What our borrowers say about us

Quick Funding

Let’s get you the funding you need. Apply for your home equity loan today!

Please fill in your loan details:

You can also contact us directly at:

1-888-269-1988 or 1-416-999-3993.

If you have a Mortgage Broker, ask about EquityLine MIC mortgages.